Providers can only charge within the NDIS Pricing Arrangements and Price Limits Guide (The Guide). The Guide sets out the claiming rules: the what, the when and the maximum amounts. If you are providing services under NDIS, you need to know The Guide, and charge correctly.

One of the areas we see a lot of confusion in, is when providers are claiming travel charges. The Guide discusses this under the heading Claiming for Non-direct Services: Provider Travel. You need to follow the conditions in The Guide if you want to charge travel costs.

Before you can charge

- Does The Guide allow travel to be charged for the service you a providing? Not all supports can claim travel, so check the specific support you are claiming under.

- For example, you are providing support work to a participant. Search The Guide for your services, such as Assistance with Self Care Activities. Under that heading you can see if provider travel can be charged.

- Has the participant agreed in advance to your travel charge? You would usually write travel and other charges into your service agreement. You have to discuss and agree on all charges with your participant beforehand.

- Is your support disability specific for your participant? If it is not, you cannot claim travel, nor can you claim the support from the NDIS.

- Does the provider need to be paid for their time travelling? Travel can only be claimed if:

- the provider has to be paid for their travel time by their employer, or

- the provider is a sole trader and is travelling from or to the participant (or between participants).

- Was the support delivered face to face? You cannot claim travel charges if you are not meeting with the participant face to face.

- For example, you are an OT, and you drive to an equipment store to review equipment for a participant. The participant is not at the store with you, so therefore you are providing a non-face to face service. You cannot claim travel.

- In the above scenario, if you and the participant are at the store together, you are providing a face to face service. You can claim travel.

What you can charge

There are two parts to ‘Provider Travel’. One is the labour charge – the time taken to get to the participant (or back again) to provide the support. The other is the non-labour charge – like running costs of the car, road tolls, and parking fees.

Labour Charges

- How much you can charge is based on where the participant is, not where you are travelling from. You need to look up the participant’s address to see what their ‘MMM’ classification is. We have provided a link at the bottom of this post for you. (The Workforce locator)

- MMM1-3 is a maximum of 30 minutes on each eligible trip.MMM4-5 is a maximum of 60 minutes on each eligible trip.

- Regional, remote or very remote charges can be split up differently. You will need to agree on these with the participant beforehand.

- You can charge from the participant back to your usual place of work. This only applies if you have to be paid for that time. If you normally work in an office, and you are going home after the last participant, you cannot claim the return trip.

- The code you use for your travel time is the same as the code for your service. If you are a cleaner, you are still a cleaner when you are travelling.

- Your service time is charged under the relevant code. For example, two hours of cleaning at the cleaning code of 01_020_0120_1_1.

- Your travel time is charged under the same code. For example, 01_020_0120_1_1, with a note to show “Travel time” and the time charged (e.g. 0.5 hours).

- The hourly rate you charge for travel is the same (or less) than what your service is. If you are charging $50 per hour to clean, you can charge $30 per hour travel for example.

Non-Labour Charges

- Your participant can agree to your claiming a per km cost to cover the running costs of your vehicle. For example, you might claim 97c per km for your trip to them.

- If you have other costs, you can also claim these (with prior agreement). For example, the full amount of road tolls or parking fees. If you are using public transport, you can claim those costs instead of the above km costs.

- These costs can only be claimed if they have actually been occurred. You cannot charge a nominal fee for non-labour charges, even if the participant agrees.

- If you are seeing several participants in one area, you can divide these charges between them. Make sure to discuss this with your participants first and get their approval.

- The code you use depends on the service you have provided. There are many, many codes for provider non-labour charges. The Guide will tell you which codes can be used with the service you are providing. The code will start with the same two numbers as the service you are providing. The next three numbers will always be 799. The next four numbers will also match your service code.

- For example, the cleaning code of 01_020_0120_1_1 has a non-labour code of 01_799_0120_1_1.

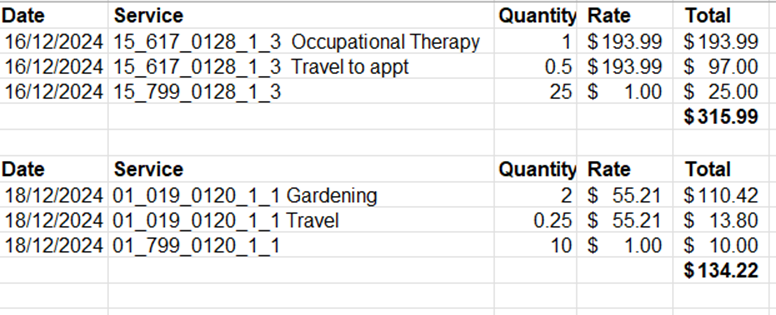

- An OT would charge under 15_617_0128_1_3 for the service and travel time. The non-labour charges would be under 15_799_0128_1_3.

Cancellations and Travel Claims

Sometimes, your participant may need to cancel your service on short notice. You may be able to claim a cancellation charge for that – but that’s a whole other blog post! If you can claim for your cancelled service, can you claim for the travel as well?

You can claim for your travel time under a cancellation if:

- You had to set aside time for travel to get to / from the participant; and

- You have not been able to fill that time slot with other, paid work.

Can non-labour costs be claimed under a cancellation?

- If you have incurred the costs, then yes they can be claimed.

- For example – you have driven to the participant’s home to provide your service. You find they are not home, and you cannot get hold of them within a reasonable timeframe. You then drive back to the office as you had planned to after the appointment. In this case, you can claim the costs, because you incurred them.

- If you have not incurred the costs, they cannot be claimed.

- For example – your participant cancels while you are at another appointment. Instead of driving to see them, you then travel back to the office. In this case, you have not incurred the costs, so cannot claim them.

Working with the plan manager

Your participant’s plan manager has to claim travel charges correctly from the NDIS. If they are not sure exactly what you are claiming, they may need to get in touch with you. State travel charges correctly on your invoices to speed up payment. We have provided some examples for you here.

Activity Based Transport

The above information relates to a provider who is charging travel time and kms for when they are traveling to or from a participant. You may also be able to claim for Activity Based Transport – where you have the participant in the car with you. It is also a brand new topic, so make sure to check that out if you’re driving your participant in your car.

Links

https://www.ndis.gov.au/providers/pricing-arrangements

https://www.health.gov.au/resources/apps-and-tools/health-workforce-locator/app

https://teamdsc.com.au/on-demand/travel-and-transport