Activity Based Transport (ABT) is usually claimed by support workers and group programs. We often find providers aren’t sure of when they can claim it, or how much they can claim. The NDIS allows claims for Transport, Travel and Activity Based Transport, just to make life more confusing!

What is Activity Based Transport?

Let’s explain this with some examples.

Example 1 – Driving in your car

You are a support worker, and you work with an NDIS participant, Phoenix. They have asked you to take them shopping on your next shift. You start the shift at Phoenix’s house, where you help them get ready to go out. To get to the shops, you and Phoenix take your car. After shopping, you drive Phoenix back to their house, where you help them pack away the shopping.

In this scenario, you will be claiming your time while supporting Phoenix. You can also claim ABT by charging a fee per km travelled. The kms can be charged from Phoenix’s house to the shops, and back again. The key factor here is that you are driving the participant in your car.

Example 2 – Group bus trip

You are a provider of group supports. Sometimes you take a group of participants out for a trip in the community. Today, your group of four meets at your centre, and then you all get on your bus to go bowling. During the bus trip and at bowling, there are two support workers to support all four participants. You all drive back to the centre in the bus.

For this scenario, you would be claiming the time of two support workers. As there are four participants, you split the charges between them (1:2 ratio). You used your bus to drive everyone, so you can also claim ABT. Let’s say it was a 60km round trip to get from your centre to bowling, and back again. As it was a group trip, you have to divide the cost of the kms as well. So you would charge 15km per participant for ABT.

Example 3 – Skill building on public transport

Your participant, Chris, is about to start a new job. They need help with navigating public transport to their new place of work. You meet Chris at their house and then walk to the bus stop together. While on the bus, you support Chris to regulate and keep track of landmarks. Chris pushes the bell when you need to get off the bus, and then you walk to their new job together. After a look around, you walk back to the bus stop and navigate the trip home. You finish your shift once Chris is back at home.

While you did not drive Chris in your car during this shift, you still incurred costs. The cost of your bus tickets can be claimed back as ABT.

Example 4 – Driving in the participant’s car

One of your participants, Wren, has their own car which has been modified for their disability. During one of your shifts, you drive with Wren in their car to visit a family member who lives an hour away.

As you are not incurring any costs for the trip, you cannot claim ABT. You can still claim for your time while you were supporting Wren.

To be providing ABT you must be:

- Providing a support to the participant that is more than just driving them. A Taxi service or Uber is not ABT.

- Travelling together with the participant.

- Incurring a cost on top of your time. For example: running costs of your car, public transport fares, road tolls, parking.

When Can you Claim ABT?

- When it meets the above criteria.

- If the NDIS Pricing Arrangements and Price Limits Guide (The Guide) says you can. Not all types of supports can claim ABT, so check The Guide first.

- When your participant has agreed to it beforehand. Write it into your service agreement and discuss it during your onboarding process!

How do you claim ABT on your invoice?

You need to claim ABT as a separate line on your invoice. The Guide lists the various codes you use, depending on the support you are providing. It’s important that you match the ABT code to your support. Look up the support you are providing in The Guide, and it will tell you which ABT code you can use.

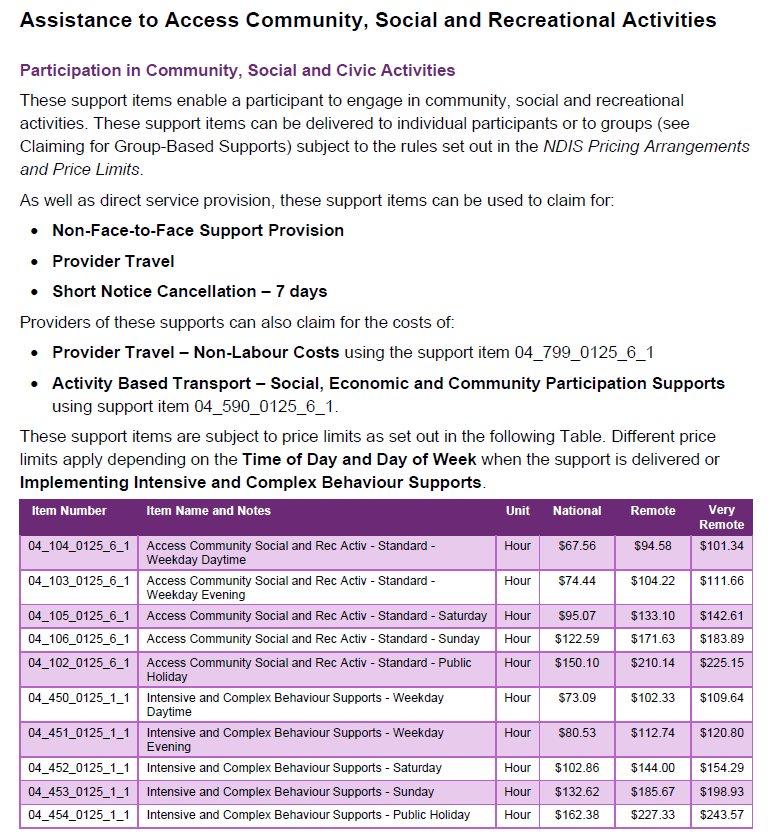

For example, you are providing support work in the community. The Guide shows you (October 2024 page 59):

You claim your support on one line, and the ABT on another. As an example:

17/1/25 04_104_0125_6_1 Access Community 2 hours @ $ 50 = $100

17/1/25 04_590_0125_6_1 Activity Based Transport 25 kms @ $1 = $25

The Guide gives you a recommendation for what is a ‘reasonable’ amount per km. Look for the heading, “Claiming for Activity Based Transport”. Your participant must agree to the amount you charge beforehand.

But what if…

You are supporting Wren in their home today, and they ask you to drive to the chemist to pick up their script. As it’s only a short drive, they’re happy to stay home while you go alone. When you go to invoice for your support, you are now confused how to invoice for this.

You can charge for the entire shift time at your usual rate. Picking up Wren’s script is still supporting them, so your time is still claimable. Charging for the kms is a bit trickier, however.

As Wren was not in the car with you, it is not really ABT (or Transport). It also does not meet the criteria of Provider Travel, as it happened while you were already on shift. What makes it even more confusing, is that you were providing your supports at Wren’s home. The Guide tells you that if you are charging under Assistance with Self-Care Activities, you cannot charge ABT.

This is one of the (many) grey areas of NDIS charging. Technically, you should separate hours provided ‘at home’ and ‘in the community’. If you were at home with Wren for some of the shift, and out in the community for the rest, you would charge under two lines. Or you could decide that most of the shift was spent at home, so you will charge all of it at that code. To help keep invoicing costs down, most providers work on the ‘majority’ principle. They charge the entire shift under one code if it was only a couple of hours. Longer shifts may get split into two different categories.

As Wren was not with you, they also weren’t really “engaging in community activities”. Going just by The Guide, your trip to the chemist does not fit into any of the categories. You would not be able to claim for your support or the kms.

You don’t want to tell Wren that they have to get in the car with you to come to the chemist so you can fit into a neat category. You discuss how to claim the time and kms with Wren. Wren is happy for you to charge the shift as supports at home. They also agree to ABT, as that’s how you would have claimed if they had gone in your car with you. Your invoice shows your supports as being provided ‘at home’, and a separate line for ABT. Wren’s plan manager queries you about this, and you explain the situation to them. They may ask you to change your support code, or they may put it through.

Issues with claiming ABT

As a plan manager, we may have to send your invoice back for corrections. Some issues when you are claiming ABT might be:

- You haven’t specified whether the claim is ABT, travel or transport. Each of those has a different code, and if we can’t identify the code, we can’t claim it.

- The service you are providing does not let you claim ABT. For example, if you are charging under a Counselling code, you cannot claim ABT. Check The Guide to make sure you can claim.

- You are using the wrong ABT code. Your code has to ‘match’ the service you’ve provided. It has to come from the same budget category, and the same registration group code as your support. The Guide explains those terms to you. If you’re not sure, ask!

- The amount of kms you are charging may not ‘fit’ the time you spent on your support. For example, you’re claiming two hours of support, and 300kms as ABT. We’d be a bit concerned at you driving 150kms per hour! In cases like this, we put your invoice on hold and ask you to check your figures.

Links

https://www.ndis.gov.au/providers/pricing-arrangements The DOC or PDF versions explain when you can claim ABT.